CSX Corporation announced Wednesday May 12th, that it has signed an agreement with Quality Distribution to acquire bulk liquid chemicals transportation provider Quality Carriers Inc. (QC). No terms of the agreement were released.

Headquartered in Tampa, FL, QC operates the largest liquid bulk chemical trucking network in North America. QC’s network of company terminals, independent affiliates and independent owner-operators provides nationwide liquid bulk chemical transportation and related services. Quality Carriers management team will continue to lead the chemical transportation entity as a part of CSX. QC’s president, Randy Strutz shared that existing synergies between the two companies will offer better efficiencies for their customers. “Together, we will be exceptionally positioned to provide our customers – many of which have existing relationships with both CSX and Quality Carriers – with a unique and seamless rail-to-highway offering. We look forward to partnering with CSX and to create a new level of efficiency for bulk chemicals transportation.”

CSXT’s president and CEO James Foote said, “our new partnership will provide chemical producers and shippers with a first-of-its-kind multimodal solution that capitalizes on the powerful synergies between Quality Carriers’ truck transportation fleet and our cost-advantaged rail network. We believe that this new capability will create meaningful long-term value for our company.”

Our assumption is that most of these multimodal synergies will be realized through combining rail and truckload movements using CSXT’s TRANSFLO bulk terminal network. There are currently 38 TRANSFLO’s terminals spread across CSXT’s 21,000-mile network. These terminals are operated by 3rd party companies whose competency is materials handling, not trucking. By design, this was intended to promote competitive final mile delivery through the open access to outside motor carriers.

The following map shows the relationship of QC’s network (including their bulk container division – Boasso America) and CSXT TRANSFLO terminals with CSXT’s rail network.

If CSXT transitions the operations of their TRANSFLO terminals to QC, it would not be long before QC is handling a significant portion of the bulk liquid truckload portion of the movements. Today, all of the Class I rail carriers “market price.” They do so, simply because they can. Unlike rail, a shipper can negotiate price and service with several motor carriers. Will CSXT market price the rail-truck combination, or allow shippers the ability to negotiate and select their own carrier without penalty on the rail portion of the movement?

For the CSXT, managing this multimodal scenario will require more of a supply-chain vision. Do not be surprised if CSXT throws their hat into the already crowded 3rd party logistics world with a new entity like the Union Pacific’s – LOUP and BNSF’s – BNSF Logistics.

2021 continues to be the year of mergers & acquisitions, and we are not even halfway through the year!

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders.

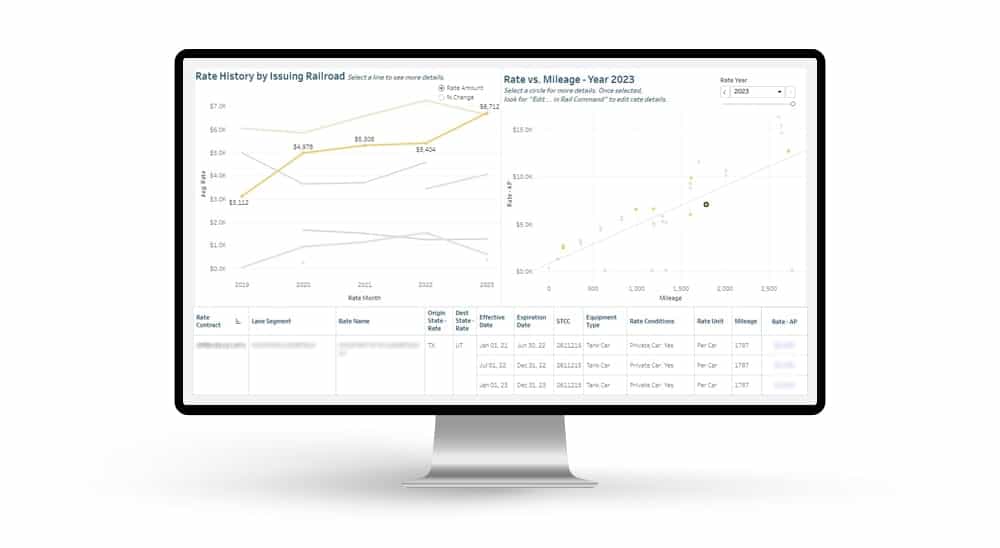

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders. Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.

Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.