As the year 2020 was winding down, we were all quick to look ahead to 2021. Though 2020 had been a trying year, what can we now expect as we move forward? 2020 may have left us with more questions than answers.

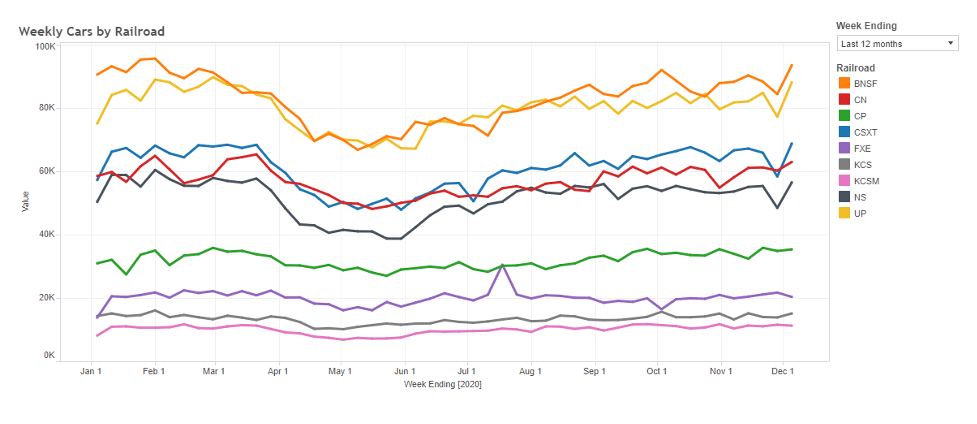

While we can begin to see the beginning of the end of the pandemic now that 2 vaccines have been approved by the FDA, will the railroads be able to staff their crews at a rate that keeps up with increased rail shipping volume? From what we saw in late summer, volumes did begin to increase. However, things weren’t so smooth then. The railroads had not brought back all of their crews in time to handle more carloads. The result was a lot of missed switches and other delays that caused some frustration. As you can see in the chart below, volumes are showing a bit of an upward trend as we reached the end of 2020. We will have to wait and see if this will continue into 2021 and if the railroads then will be staffed appropriately.

With the fluctuating volume throughout 2020 also came service issues as the railroads were also trying to adjust to the ebb and flow of railcars. As we rounded out 2020 it seems to have left us with first mile/last mile service issues and reduced service days at plant locations due to staff reductions. Some geographical areas seem to have been hit harder than others as the effects of Covid-19 worked its way through the railroad staff.

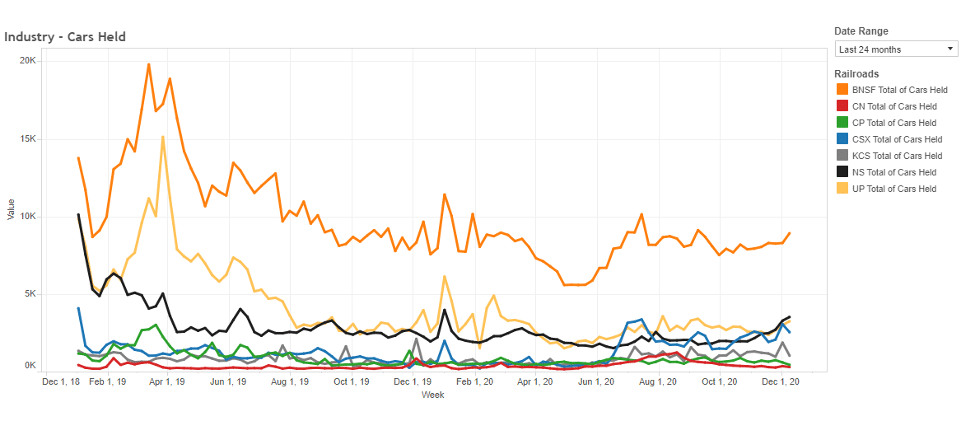

Rail shippers may now be used to variability in rail service if you recall the adjustments that took place while each of the class 1 railroads implemented components of precision scheduled railroading. As we can see in the chart below that represents the number of cars that have not moved in 48+ hours based on daily snapshots throughout the week, things haven’t been as ‘bad’ as they were during the PSR days, however the fluctuations are still not easy to deal with.

Beyond the boots on the ground crews, it has been hit or miss in trying to reach customer service support at the various railroads. In some cases, it has taken several days to get any type of response from some of them, again due to staff being affected by Covid-19.

It is more important than ever that rail shippers have good visibility of their rail shipments as well as a good understanding of their anticipated transit times. Understanding this will give the rail shippers the power to plan and make adjustments in these uncertain times. Rail shippers need to plan ahead as much as possible, build a little more inventory than normal, and possibly utilize other back up transportation modes a little more often.

As you can imagine, some shippers opted to send their tank cars into shop for qualification and other planned repairs while their shipping volumes were down. This seems like a good idea if the railcars were otherwise sitting idle and possibly accruing demurrage or storage charges. This activity caused the typical end of year demand at the shops to kick in much earlier than normal. The result of this was longer turn times at the various shops. If your demand for railcar shipments started to increase mid-summer like many did, you may have found yourself short-handed while your cars were waiting their turn at the various shops. While we work with shippers to plan their qualifications and planned maintenance activities in advance, knowing how many railcars each month should be sent to shop, 2020 was one of those years where best laid plans don’t always pan out. The shops do seem to be doing their best to keep things moving as quickly as possible. Shippers can help by staying on top of estimate approvals and providing good dispo instructions in a timely manner.

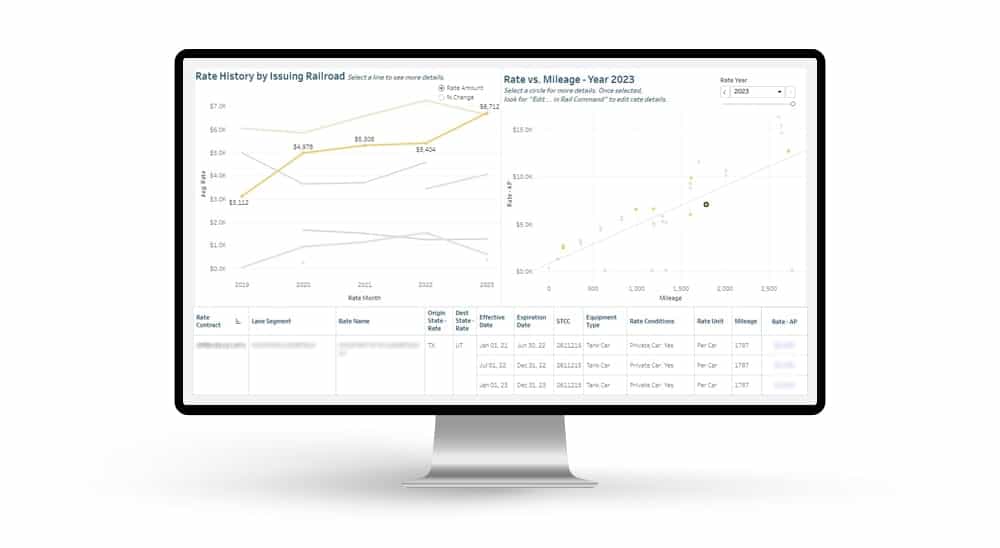

On the bright side, rail shippers may be able to ride the wave of railroads being a little more aggressive as it pertains to negotiating rates. The class 1 railroads, in general, do seem to be more open to looking at new opportunities and providing competitive quotes. This would be a good time to review any competitive lanes that you may have. We should expect to see this trend continue on into the first half of 2021, or at least until rail shipping volumes stabilize.

Rail shippers have also been able to enjoy lower fuel surcharge rates as the demand remains lower. Expect this to go up throughout 2021 as well. This chart displays the effect that the pandemic had on our fuel surcharge rates almost immediately, but you will also see the numbers climbing back up near the end of 2020.

I believe we are all feeling a bit of belief, hope and optimism as we navigate into 2021. Although we can’t reach out and touch it, we can see the light at the end of the tunnel. We expect shipping volume to improve, we believe that railroads will be able to staff appropriately, and we hope that by the end of 2021 we will see growth and stability.

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders.

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders. Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.

Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.