New Carta Porte Information

Additional changes to the Carta Porte, as mandated by the Mexican Tax Authority, were recently announced. This new requirement was issued by the Servicio de Administración Tributaria, also known as the SAT. The new Carta Porte requirements will be effective July 31, 2023.

Complete list of Carta Porte Requirements to be prepared for:

As of December 1, 2021, anything shipped with the commodities listed as Freight All Kinds will not be accepted.

As of January 1, 2022, shippers are required to include the following on EDI-generated bill of lading and shipping documents:

- SAT Commodity Code

- Customs Tariff Code

- UN/NA Identification Code (hazmat only)

- Universal Unique Identifier (Mexico origins only)

- Commodity description

As of November 1, 2022, KCSM is rejecting shipments without the following on the EDI-generated bill of lading and shipping documents:

- SAT Commodity Code

- Customs Tariff Code

- UN/NA Identification Code (hazmat only)

- Universal Unique Identifier (Mexico origins only)

- Commodity description

- Shipper Federal Tax ID

- Shipper 24-Hr Contact (name, phone and email address)

- Consignee Federal Tax ID

- Payor of Freight Federal Tax ID

Upcoming Carta Porte Requirements

As of July 31, 2023, shippers are required to include all of the above on the EDI-generated bill of lading and shipping documents to the origin line haul railroad. Some of the railroads have adapted their shipping pages for these fields although not all are currently established. RSI Logistics has completed the EDI set up directly and can be used to send EDI to the origin line haul railroads with pertinent Carta Porte information today. Contact our team to find out more!

Starting July 31, 2023, penalties for incomplete information will incur railroad fees for the Mexican portion of the shipment and may be at risk of border set outs, clearance, or interchange delays.

What is Carta Porte:

The Carta Porte is a Mexican tax receipt for merchandise being transported and will soon replace the standard transfer invoice and logistics letter.

Changes to the Carta Porte, as mandated by the Mexican Tax Authority, were recently announced. This new requirement was issued by the Servicio de Administración Tributaria, also known as the SAT. The new Carta Porte requirements will be effective January 1, 2022, for all modes of transportation on any cross border and/or Mexico domestic shipments; this includes rail, truck, water, and air.

The first requirement was effective on December 1, 2021, and pertained to Freight All Kinds (FAK). On December 1, 2021, anything shipped with the commodities listed as Freight All Kinds would not be accepted.

The second requirement will be effective on January 1, 2022. This change requires shippers to include new fields on the EDI-generated Bill of Lading and shipping documents. Shippers will be required to provide additional information for any import, export, or Mexico domestic shipments. These fields include:

- SAT Commodity Code

- Customs Tariff Code

- UN/NA Identification Code (hazmat only)

- Universal Unique Identifier (Mexico origins only)

- Commodity description

What do I need to do:

If you are wondering what you need to do to be compliant with the upcoming changes, here are some helpful tips.

To ensure there will not be any delays with your goods, and that all the shipping documentation is accurate, you will need to have the newly required information correct prior to shipping.

We recommend connecting with your customers, and your Mexico brokers to obtain the required information. Failure to provide the newly required information may result in delayed shipments and penalties on the Mexican portion of the shipment, so we recommend implementing this as soon as possible.

Here are the newly required fields and how to obtain this information.

SAT Commodity Code

Work with your Mexican Customs Broker(s) to obtain the required SAT code.

Customs Tariff Code

While similar to the Harmonized Schedule tariff Code, this code will have a different number and format. Work with your Mexican Custom Broker(s) to obtain the required Customs Tariff Code.

UN/NA Identification Code (Hazmat Only)

The UN number is a four-digit code that identifies hazardous materials. This number can be found on your Safety Data Sheet (SDS) and/or the Code of Federal Regulations (CFR) Title 49.

Universal Unique Identifier (Mexico Origins Only)

The Universal Unique Identifier (UUID) is a 36-character number provided by the Mexican SAT Authorities. The SAT generates the UUID, which be obtained from your Mexican Customs Broker(s).

Commodity Description

FAK (Freight All Kinds) is no longer accepted by the SAT, effective December 1st, 2021. Ensure you have an updated commodity description for your rail freight.

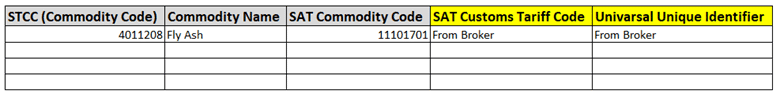

Here is an example of the newly required fields.

How RSI can help:

On December 10th, 2021, our team successfully deployed these required fields into our Rail TMS, RSInet. RSI also modified the Electronic Data Interchange (EDI) Bill of Lading documents to comply with the Carta Porte requirements that go into effect January 1st, 2022.

RSI is working with each of our clients to obtain the required information and update the necessary fields in RSInet. RSI is also working directly with Mexican and American brokers to obtain the required information on behalf of our clients.

If you are not an existing RSI client, please contact us to learn how we can help.

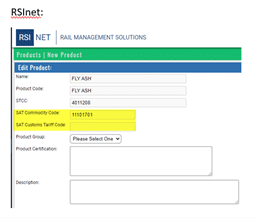

What this looks like in a Rail TMS

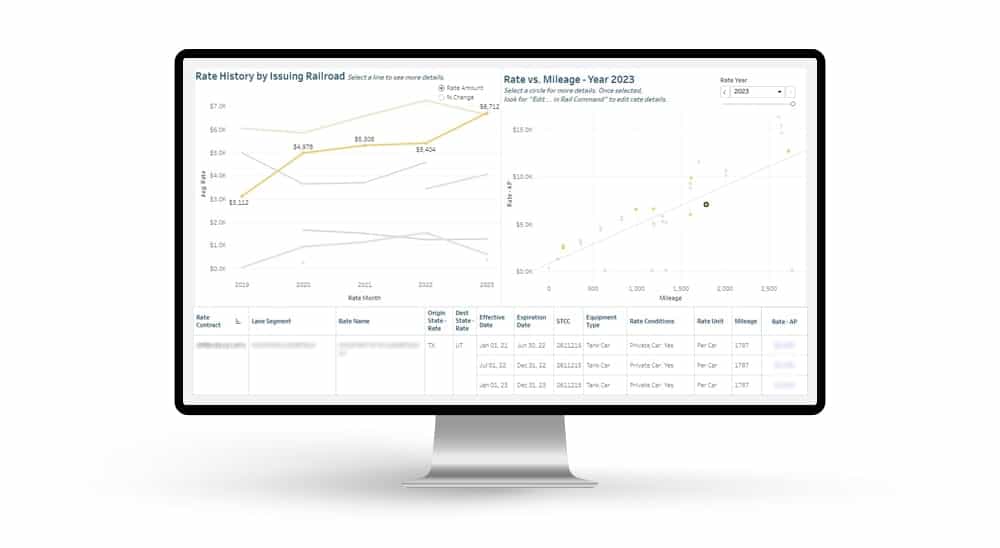

RSInet is your single railcar tracking software for managing rail transportation data: railcar movements, rates, equipment, and freight charges.

These Carta Porte fields can be seen in the product section of RSInet:

- SAT Commodity Code

- SAT Customs Tariff Code

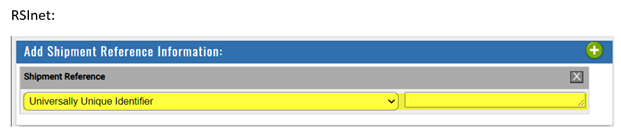

The Univeral Unique Identifier (UUID) can be found at the pattern and shipment level in RSInet. This field is found in the Shipment Reference Information:

- Universal Unique Identifier

Conclusion

All shippers, regardless of their destination or commodities, should be aware of the changes being implemented by Mexico and their Servicio de Administración Tributaria. However, if you ship to Mexico, it is paramount that you make these changes to ensure your shipments will be received on time.

Learn more about RSI’s Rail TMS, RSInet, here. Need help managing your rail transportation? RSI offers comprehensive logistics services, learn more here.

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders.

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders. Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.

Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.