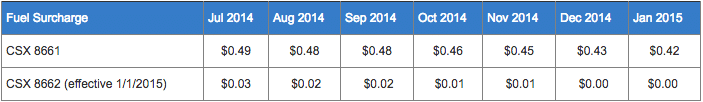

CSXT announced last July that they were going to re-baseline their mileage based fuel surcharge (Tariff 8661) with a new tariff (8662) effective Jan. 1, 2015. These fuel surcharges apply to CSXT tariff rates, not rates covered under contracts or confidential quotes. Apparently CSX foresaw the coming drop in oil prices as the HDF price has been below their new strike price of $3.749 since the beginning of October. The table below compares the old and new FSC rate schedules:

In the meantime, CSX has revised many of their public freight rates as of January 1st. For commodities that RSI is involved with, we are seeing average rate increases between 3% and 9%. A sampling of 300 lanes over 35 commodities had the following characteristics: the total cost of 92% of the lanes increased, the average increase is 4.4% and the median increase is 4.8%, 2.5% of the increases are more than 10%, and the most frequently occurring increases are between five and six percent. We have noticed lube oil, glycerin, and steel experiencing particularly large increases. Going forward there are two issues to be mindful of: the gap between the current and the revised rates will increase as fuel continues to drop. Second, all future rate increases are escalated after a railroad restructures rates by adding fuel costs on to the base rate.

On December 18th, Genesse and Wyoming followed suite by announcing they are resetting their mileage based fuel surcharge (Tariff 9004) with a strike price of $3.70 HDF effective January 1st for their railroads in the Midwest region. On December 16th, BNSF announced that they will eliminate their fuel surcharge program for carload traffic in February, 2015. BNSF will convert all BNSF carload public price authorities to a single freight rate. It’s interesting to note that BNSF led the way in instituting fuel surcharges in 2003, and FSCs have been a point of contention between shippers and railroads ever since. In 2007 the Surface Transportation Board ruled that some of the ways the railroads were computing fuel surcharges were unreasonable (Ex Parte No. 661). It will be interesting to see how this will play out in 2015. As fuel costs increase, BNSF could implement a new fuel surcharge or make adjustments to the rates in their tariffs. If fuel costs are going to be contained in the freight rates, it is likely that there will be more frequent rate updates. If keeping up with these changes are a hassle, rate database management and freight auditing services from RSI Logistics are available!

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders.

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders. Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.

Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.