CN is implementing changes to their Optional Services tariffs, which will take effect on February 1st, 2017.

Carbon Taxes:

- Effective April 1st, 2017 a carbon tax will also be applied for shipments travelling to, from or within Alberta. (A carbon tax fee was imposed by British Columbia in 2008.) This tax will be calculated as a per mile charge for carload traffic, while fees for intermodal traffic will be applied per unit.

- Also effective April 1st, 2017, the British Columbia Carbon Tax fee will change from $18.60 per car fee to a per mile charge of $.04 (Carload). The tax for Intermodal traffic will continue to be applied per unit.

- If traffic is passing through both provinces, both carbon taxes will apply.

- Mileage will be calculated using the same software as the fuel surcharge, PC*MILER-Rail.

- Carbon taxes will be shown as a separate line item on the freight invoice, however you will have the option to be receive a separate monthly invoice.

Some other charges for that are changing for carloads include an increase in border hold fees, fees for overloaded or improperly loaded cars are increasing from $5oo to $2000 and if they are unsafe to move forward the fee increases threefold. Securing a leaking railcar increases from $10,000 to $15,000.

Below is a listing of the publications that are affected. A summary of the upcoming changes can be found at the end of each document.

- CN 9000: Carload

- CN 9002: Automotive Services

- CN 9003: Dimensional Load Services

- CN 9004: Unit Train

- CN 9100: Intermodal

Full CN Announcement available here.

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders.

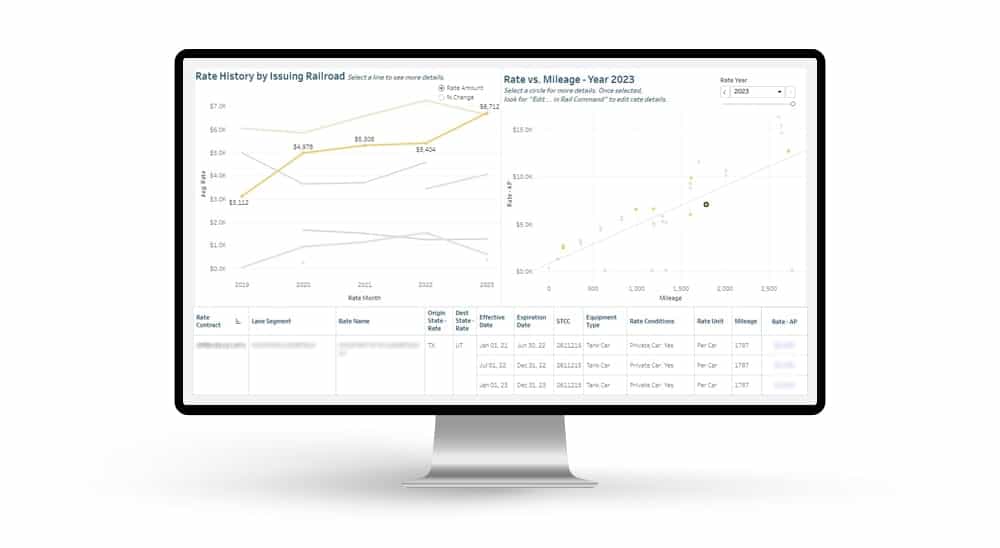

Automated exception reporting of the railcar tracking data makes it easy to identify and troubleshoot jeopardized shipments, thereby enabling you to provide better service to your stakeholders. Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.

Receive notification of pending rate expirations. Tariff changes and fuel surcharges can be automatically updated.